Business

Cabinet Approves Rs 17,000 Crore PLI Scheme for IT Hardware

The Cabinet, chaired by Prime Minister Narendra Modi, approved the Production Linked Incentive Scheme 2.0 for IT Hardware with with Rs 17,000 crore budget.

The PLI scheme for IT hardware has been changed in response to industry feedback. Budgetary expenditures for it will total Rs 17,000 crore. The programme is anticipated to generate an additional Rs 2,430 crore in investment and 75,000 jobs.

The production of electronics in India has increased steadily over the past eight years at a Compound Annual Growth Rate (CAGR) of 17%, surpassing a significant production milestone this year of USD 105 billion.

The budgetary outlay for IT PLI is Rs 17,000 crore. The program’s duration is six years. After the cabinet meeting, Ashwini Vaishnaw, the union’s minister for IT and telecom, spoke to reporters.

“Industry players had requested the government to enhance outlay for the segment”

PLI Scheme 2.0 for IT hardware includes servers, ultra-small form factor devices, all-in-one PCs, laptops, and tablets.

The scheme, according to the minister, is anticipated to result in increased production of Rs 3.35 lakh crore, increased investment of Rs 2,430 crore, and increased direct employment for 75,000 people over the course of the scheme.

The PLI scheme for IT hardware, which will cost Rs 7,350 crore and cover the production of laptops, tablets, All-in-One PCs, and servers, was approved by the government in February 2021.

The PLI Scheme, which was introduced in April 2020 with a focus on the manufacturing of mobile phones, has significantly increased the nation’s electronics manufacturing. India is now the second-largest producer of mobile phones worldwide. In March, mobile phone exports reached a significant milestone of USD 11 billion (roughly Rs 90 thousand crore). India is becoming a major electronics manufacturing nation as the global electronics manufacturing ecosystem moves there.

The Union Cabinet has approved PLI Scheme 2.0 for IT hardware

Major international producers of IT hardware are anticipated to establish production facilities in India as a result of the programme. This will increase domestic production of IT hardware, decrease reliance on imports, and generate employment in the industry.

The programme will also assist India in becoming a hub for the production of IT hardware on a global scale. This will be consistent with the government’s goal of growing India’s economy to $5 trillion by 2025.

A significant step towards achieving this objective is the approval of the PLI scheme for IT hardware. It will contribute to the expansion of India’s electronics manufacturing industry and lay a solid foundation for future economic development.

Business

Domestic Airline Go First Continues Flight Suspension

Go First has extended the suspension of its domestic flights until May 28. Airline previously said it would stop flying until May 26.

Go First, a domestic airline, has extended the suspension of its flights until May 28 in order to address operational issues. The airline had previously stated that it would stop operating until May 26.

On May 2, Go First announced the suspension of its flights, initially for two days, and filed for involuntary insolvency. The airline had previously expressed optimism that it would soon be able to accept reservations again.

The no-frills airline ceased operations on May 3, and lessors are attempting to reclaim the aircraft they had leased to the airline. The airline is currently going through a voluntary insolvency resolution process.

The airline has been given 30 days to submit a detailed plan for the revival of its operations, including information on the availability of flyable aircraft and pilots, to the Directorate General of Civil Aviation (DGCA).

The airline has been asked to provide information regarding, among other things, the status of the availability of the fleet of operational aircraft, pilots and other personnel, maintenance plans, funding and working capital, and agreements with lessors and vendors.

“Go First Faces 30-Day Deadline to Submit Revival Plan to DGCA”

The watchdog would review the revival plan after Go First had submitted it to determine the next course of action.

The airline has stated that it will soon be able to accept new reservations. When the airline will be able to resume its flight operations is unclear, though.

Passengers are stuck because Go First’s flights have been cancelled. The airline has stated that it will give passengers who have been impacted by the cancellations full refunds.

Jobs at Risk as Airline Files for Bankruptcy

For the Indian aviation industry, the suspension of Go First’s flights represents a significant setback. Millions of passengers’ travel plans will be impacted by the suspension of the airline, one of India’s largest domestic carriers.

The airline’s bankruptcy proceedings are also probably going to hurt the Indian aviation sector. Millions of passengers’ travel plans could be disrupted and jobs lost if the airline were to close as a result of the proceedings.

The COVID-19 pandemic is already posing difficulties for the Indian aviation sector. The industry has already taken a hit from the cancellation of Go First’s flights, and more job losses and travel delays may follow.

Business

Reliance JioMart Lays Off 1,000 Employees, More Cuts Likely

The layoffs are reportedly part of a larger cost-cutting measure by Reliance Retail. The company is also planning to shut more than half of the centres.

The largest retailer in India, Reliance Retail, is integrating METRO Cash & Carry India into its business-to-business (B2B) vertical. As part of the consolidation, the company closed some warehouses and fired some workers.

According to reports, Reliance Retail is reportedly cutting costs across the board. Additionally, the company intends to close more than half of its 150+ fulfilment centres.

Reliance Retail’s decision to consolidate is interpreted as an effort to organise its business more effectively. The business wants to concentrate on JioMart, its online venture.

A significant player in the Indian e-commerce market is JioMart. The business has experienced recent rapid growth and is currently among the top three e-commerce platforms in India.

“The layoffs are a sign of the competitive nature of the Indian e-commerce market”

Reliance Retail is serious about its online business, as evidenced by the consolidation of its B2B vertical. It is evident from the company’s significant investment in JioMart that it wants to dominate the Indian e-commerce market.

JioMart Restructuring

Although the layoffs are regrettable, they are a necessary component of Reliance Retail’s growth plan. The company must be effective if it is to succeed in the face of fierce competition from other e-commerce platforms.

In the Indian e-commerce market, the consolidation of Reliance Retail’s B2B vertical is a significant development. In the upcoming months, it will be interesting to see how the company’s online business does.

Business

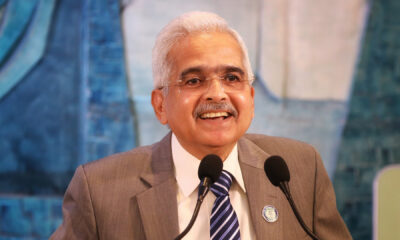

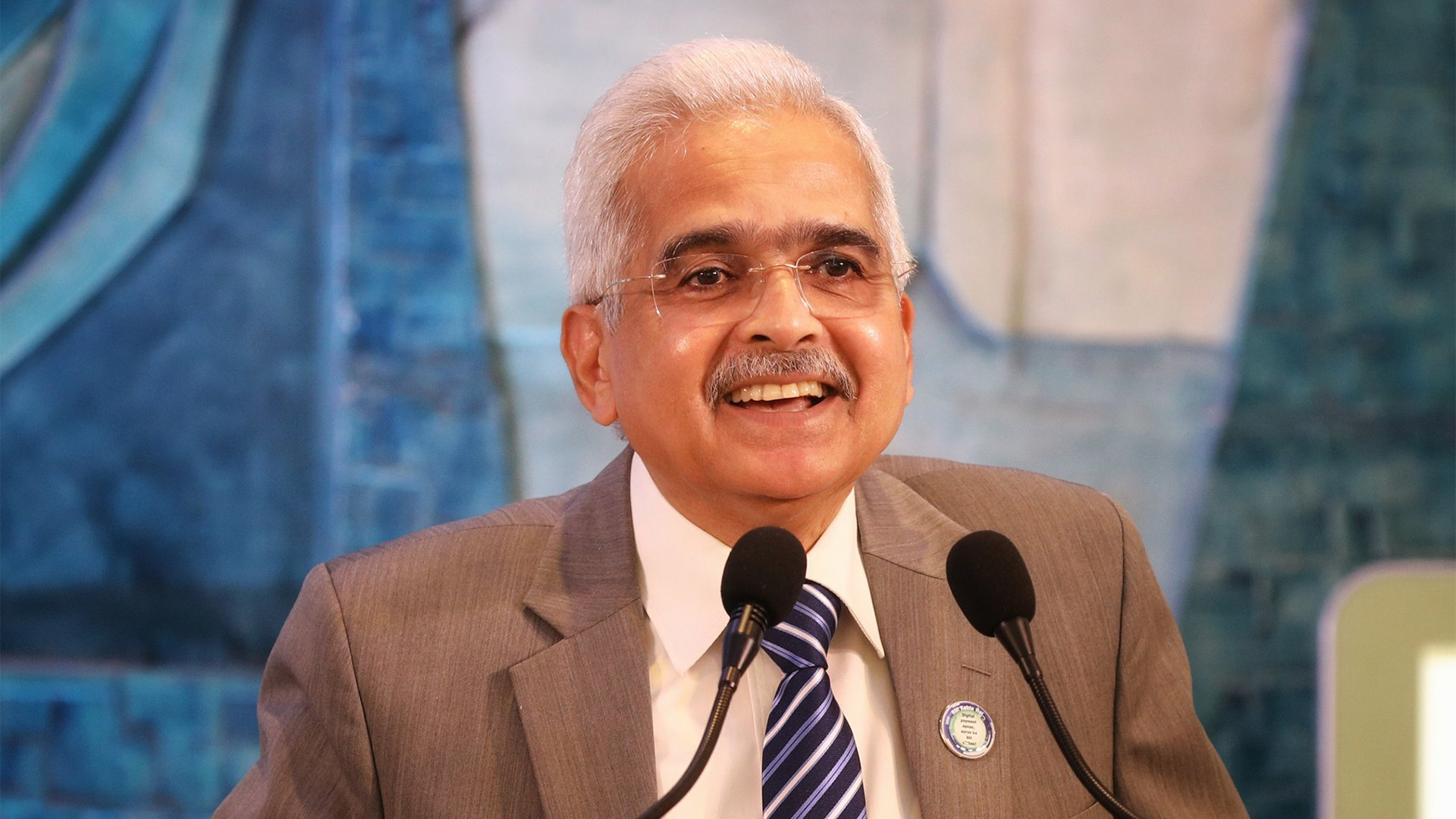

Das Explains RBI’s Decision to Withdraw Rs 2,000 Notes

The Reserve Bank of India (RBI) on Monday announced that it has decided to withdraw the Rs 2,000 denomination bank notes from circulation.

The Rs 2,000 denomination bank notes will no longer be in circulation, the Reserve Bank of India (RBI) announced on Monday. The current Rs 2,000 banknotes will still be accepted as legal tender, according to the apex bank.

Starting on May 23, 2023, any bank will allow the exchange of Rs 2,000 notes into notes of other denominations up to a cap of Rs 20,000 at a time, the central bank noted, in order to ensure operational convenience and prevent disruption of regular activities of bank branches.

The decision to remove Rs 2,000 notes is a part of the central bank’s currency management effort, according to RBI Governor Shaktikanta Das. According to him, the primary purpose of the Rs 2,000 notes was to swiftly replace older Rs 500 and Rs 1,000 notes following the 2016 demonetisation.

He continued by saying that there are currently enough notes in circulation in other denominations and that the printing of these notes has been completely halted.

Das assured that the withdrawal of the Rs 2,000 note will have a “very very marginal” impact on the economy. Only 10.8% of the currency in circulation was made up of Rs 2,000 notes.

“RBI Governor Das Says Decision Will Have ‘Very Very Marginal’ Impact on Economy”

RBI Urges Customers to Act Before September 30

Customers have until September 30 to exchange their Rs 2,000 notes or transfer the money to their bank accounts, so Das urged them not to rush to the banks. He continued by saying that non-resident Indians (NRIs), including those with H-1B visas, won’t encounter any difficulties in this regard.

He further clarified that despite the order for a withdrawal of Rs 2,000 notes, these notes are still valid forms of payment. Das added that businesses must accept these notes without objecting.

The RBI occasionally issues new notes in place of notes from a specific series, he said. The Rs. 2000 notes are being taken out of circulation, but they remain valid forms of payment.

For customers who want more information about the withdrawal of Rs 2,000 notes, the RBI has also established a helpline number. The hotline can be reached at 1800 22 77 88.

-

Fashion1 year ago

Fashion1 year agoNandita Das: Cannes is to Celebrate Films, Not Fashion

-

India1 year ago

India1 year agoOpposition to Skip New Parliament Building Inauguration

-

India1 year ago

India1 year agoNew Parliament Inaugurated by PM Modi, Opposition boycott

-

Tech1 year ago

Tech1 year agoAdobe Announces New Generative AI Features in Photoshop

-

India1 year ago

India1 year agoRBI to Withdraw ₹ 2,000 Notes from Circulation

-

Entertainment1 year ago

Entertainment1 year agoDrishyam Franchise to Expand to Korea with Official Remake

-

India1 year ago

India1 year agoJaishankar: Oppn shouldn’t politicize Parliament launch

-

Entertainment1 year ago

Entertainment1 year agoSC Pauses Ban on ‘The Kerala Story’, Orders Disclaimer