Business

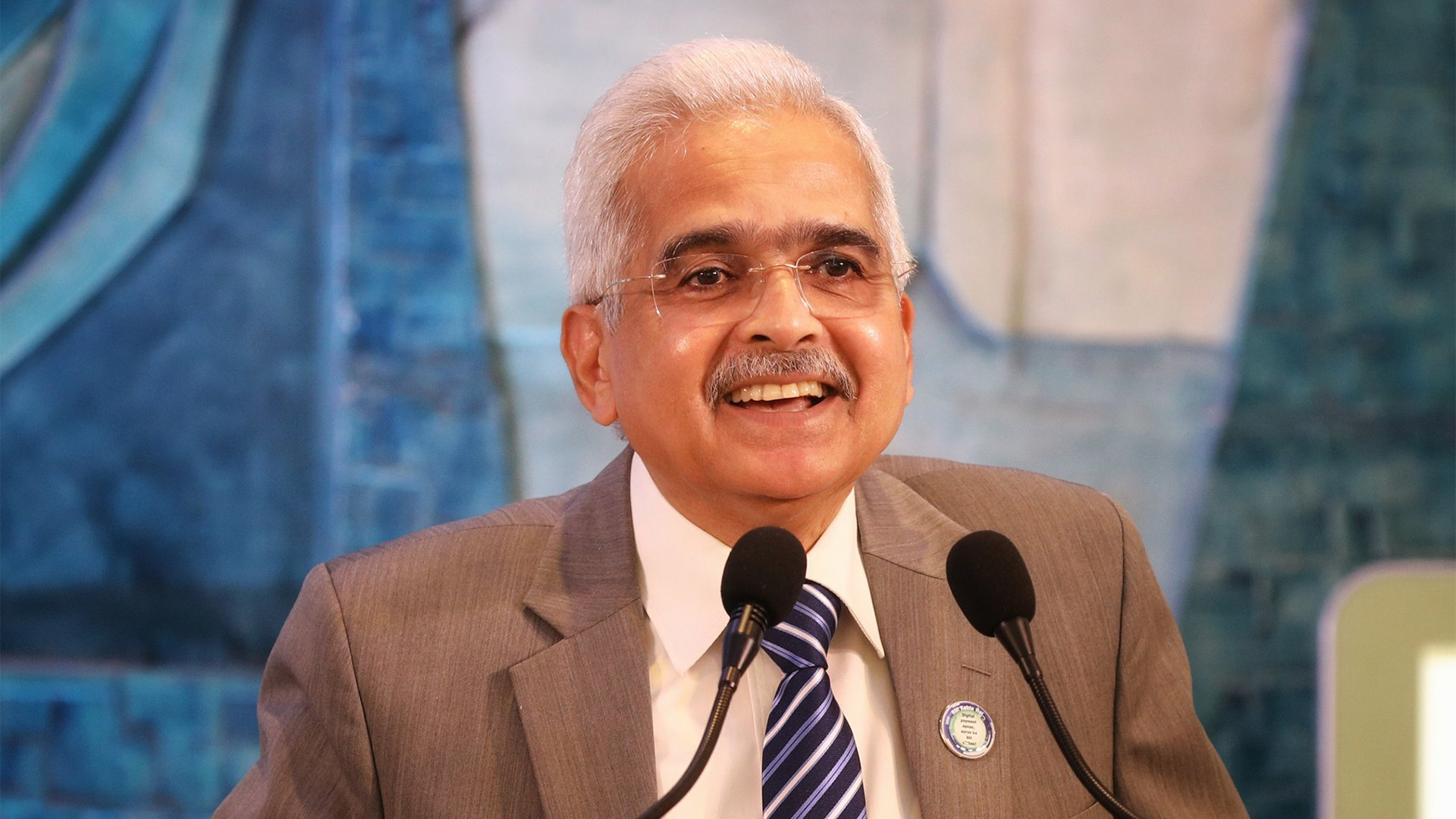

Das Explains RBI’s Decision to Withdraw Rs 2,000 Notes

The Reserve Bank of India (RBI) on Monday announced that it has decided to withdraw the Rs 2,000 denomination bank notes from circulation.

The Rs 2,000 denomination bank notes will no longer be in circulation, the Reserve Bank of India (RBI) announced on Monday. The current Rs 2,000 banknotes will still be accepted as legal tender, according to the apex bank.

Starting on May 23, 2023, any bank will allow the exchange of Rs 2,000 notes into notes of other denominations up to a cap of Rs 20,000 at a time, the central bank noted, in order to ensure operational convenience and prevent disruption of regular activities of bank branches.

The decision to remove Rs 2,000 notes is a part of the central bank’s currency management effort, according to RBI Governor Shaktikanta Das. According to him, the primary purpose of the Rs 2,000 notes was to swiftly replace older Rs 500 and Rs 1,000 notes following the 2016 demonetisation.

He continued by saying that there are currently enough notes in circulation in other denominations and that the printing of these notes has been completely halted.

Das assured that the withdrawal of the Rs 2,000 note will have a “very very marginal” impact on the economy. Only 10.8% of the currency in circulation was made up of Rs 2,000 notes.

“RBI Governor Das Says Decision Will Have ‘Very Very Marginal’ Impact on Economy”

RBI Urges Customers to Act Before September 30

Customers have until September 30 to exchange their Rs 2,000 notes or transfer the money to their bank accounts, so Das urged them not to rush to the banks. He continued by saying that non-resident Indians (NRIs), including those with H-1B visas, won’t encounter any difficulties in this regard.

He further clarified that despite the order for a withdrawal of Rs 2,000 notes, these notes are still valid forms of payment. Das added that businesses must accept these notes without objecting.

The RBI occasionally issues new notes in place of notes from a specific series, he said. The Rs. 2000 notes are being taken out of circulation, but they remain valid forms of payment.

For customers who want more information about the withdrawal of Rs 2,000 notes, the RBI has also established a helpline number. The hotline can be reached at 1800 22 77 88.

Business

Domestic Airline Go First Continues Flight Suspension

Go First has extended the suspension of its domestic flights until May 28. Airline previously said it would stop flying until May 26.

Go First, a domestic airline, has extended the suspension of its flights until May 28 in order to address operational issues. The airline had previously stated that it would stop operating until May 26.

On May 2, Go First announced the suspension of its flights, initially for two days, and filed for involuntary insolvency. The airline had previously expressed optimism that it would soon be able to accept reservations again.

The no-frills airline ceased operations on May 3, and lessors are attempting to reclaim the aircraft they had leased to the airline. The airline is currently going through a voluntary insolvency resolution process.

The airline has been given 30 days to submit a detailed plan for the revival of its operations, including information on the availability of flyable aircraft and pilots, to the Directorate General of Civil Aviation (DGCA).

The airline has been asked to provide information regarding, among other things, the status of the availability of the fleet of operational aircraft, pilots and other personnel, maintenance plans, funding and working capital, and agreements with lessors and vendors.

“Go First Faces 30-Day Deadline to Submit Revival Plan to DGCA”

The watchdog would review the revival plan after Go First had submitted it to determine the next course of action.

The airline has stated that it will soon be able to accept new reservations. When the airline will be able to resume its flight operations is unclear, though.

Passengers are stuck because Go First’s flights have been cancelled. The airline has stated that it will give passengers who have been impacted by the cancellations full refunds.

Jobs at Risk as Airline Files for Bankruptcy

For the Indian aviation industry, the suspension of Go First’s flights represents a significant setback. Millions of passengers’ travel plans will be impacted by the suspension of the airline, one of India’s largest domestic carriers.

The airline’s bankruptcy proceedings are also probably going to hurt the Indian aviation sector. Millions of passengers’ travel plans could be disrupted and jobs lost if the airline were to close as a result of the proceedings.

The COVID-19 pandemic is already posing difficulties for the Indian aviation sector. The industry has already taken a hit from the cancellation of Go First’s flights, and more job losses and travel delays may follow.

Business

Reliance JioMart Lays Off 1,000 Employees, More Cuts Likely

The layoffs are reportedly part of a larger cost-cutting measure by Reliance Retail. The company is also planning to shut more than half of the centres.

The largest retailer in India, Reliance Retail, is integrating METRO Cash & Carry India into its business-to-business (B2B) vertical. As part of the consolidation, the company closed some warehouses and fired some workers.

According to reports, Reliance Retail is reportedly cutting costs across the board. Additionally, the company intends to close more than half of its 150+ fulfilment centres.

Reliance Retail’s decision to consolidate is interpreted as an effort to organise its business more effectively. The business wants to concentrate on JioMart, its online venture.

A significant player in the Indian e-commerce market is JioMart. The business has experienced recent rapid growth and is currently among the top three e-commerce platforms in India.

“The layoffs are a sign of the competitive nature of the Indian e-commerce market”

Reliance Retail is serious about its online business, as evidenced by the consolidation of its B2B vertical. It is evident from the company’s significant investment in JioMart that it wants to dominate the Indian e-commerce market.

JioMart Restructuring

Although the layoffs are regrettable, they are a necessary component of Reliance Retail’s growth plan. The company must be effective if it is to succeed in the face of fierce competition from other e-commerce platforms.

In the Indian e-commerce market, the consolidation of Reliance Retail’s B2B vertical is a significant development. In the upcoming months, it will be interesting to see how the company’s online business does.

Business

Adani Group Cleared of Stock Manipulation Charges

A Supreme Court-appointed expert panel has found no evidence of artificial trading in Adani Group stocks in the run-up to a report by Hindenburg Research.

The panel, led by former Supreme Court judge AM Sapre, stated that it had examined trading data for Adani Group stocks from January 2010 to January 2023 and discovered no “coherent pattern of abusive trading.”

The panel also stated that it had found no evidence of “wash trades” – a type of artificial trading in which shares are bought and sold between two parties in order to artificially inflate a stock’s price.

The report comes after the Adani Group’s market value dropped by more than $100 billion following the publication of the Hindenburg report in January. The report alleged that the Adani Group inflated its profits and market value through the use of shell companies and other fraudulent means.

The Adani Group has denied all of Hindenburg Research’s allegations. The group has stated its commitment to corporate governance and transparency, as well as its willingness to cooperate with any investigation into its business practises.

“Adani Group loses over $100 billion in market value after Hindenburg report”

Supreme Court Panel Report

The report from the Supreme Court panel is a significant development in the ongoing Adani Group investigation. The report’s findings suggest there is no evidence to support Hindenburg Research’s claims of artificial trading and fraud.

The report is also detrimental to the short-seller, who has been accused of making false and deceptive statements about the Adani Group. Hindenburg Research has refuted these allegations and defended its report.

The Adani Group and its shareholders are likely to be pleased with the report of the Supreme Court panel. The findings of the report will aid in restoring faith in the group’s business practises and commitment to corporate governance.

Also likely to disappoint Hindenburg Research and its supporters is this report. The findings of the report indicate that the short seller’s accusations against the Adani Group were unfounded.

Ongoing investigation into the Adani Group. The report from the Supreme Court panel is an important development in the investigation, but it is not the last word. The investigation will likely continue for some time, and it is possible that new evidence will emerge that supports Hindenburg Research’s allegations.

-

India2 years ago

India2 years agoOpposition to Skip New Parliament Building Inauguration

-

Fashion2 years ago

Fashion2 years agoNandita Das: Cannes is to Celebrate Films, Not Fashion

-

India2 years ago

India2 years agoNew Parliament Inaugurated by PM Modi, Opposition boycott

-

Tech2 years ago

Tech2 years agoAdobe Announces New Generative AI Features in Photoshop

-

India2 years ago

India2 years agoRBI to Withdraw ₹ 2,000 Notes from Circulation

-

India2 years ago

India2 years agoJaishankar: Oppn shouldn’t politicize Parliament launch

-

India2 years ago

India2 years agoKejriwal Meets Oppn Leaders to Mobilize Against Ordinance

-

Entertainment2 years ago

Entertainment2 years agoDrishyam Franchise to Expand to Korea with Official Remake